michigan property tax rates 2020

Income Tax Brackets for Other States. As a result the interaction between Act 9 and Act 10 is expected to result in.

Tax rates in Maryland vary depending on where you live.

. Millage rates are those levied and billed in 2020. Any time a local government increases the tax rate it must hold a public hearing to discuss the new rate. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax.

Maryland Property Tax Rates. Act 10 further specifies that for tax year 2020 the amount of actual Wayfair-related sales tax revenue collected between October 1 2019 and September 30 2020 will be used to determine the first two marginal rates for 2020 and that the 2020 rates will apply for tax years 2021 and beyond. Rates for 2021 will be posted in August 2022.

Compare the state income tax rates in Arkansas with the income tax rates in 4. For Tax Year 2020 Michigan was taxed at the same flat tax rate of 425 within all levels of income. Michigan Tax Brackets for Tax Year 2020.

Rates include special assessments levied on a millage basis and levied in all of a township city or village. Michigan Tax Brackets for Tax Year 2021. Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053.

Rates also include special assessments levied on a millage basis for police fire or. Michigan is taxed at a flat tax rate of 425 for all levels of income. Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of the Pelican State.

The rates they set will depend on local revenue needs. Rates include the 1 property tax administration fee. While the state government handles property assessments in Maryland local governments still set their own tax rates.

One reason Louisiana has such low property taxes is the states generous homestead exemption which. Arkansas Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax. Compare State Tax Brackets Rates.

There are -675 days left until Tax Day on April 16th 2020.

Property Tax Defined And Explained Quicken Loans

Getting Behind On Your Taxes Is Becoming More And More Common For The American Taxpayer Anything From Your Payroll Deductions Medi Tax Debt Debt Filing Taxes

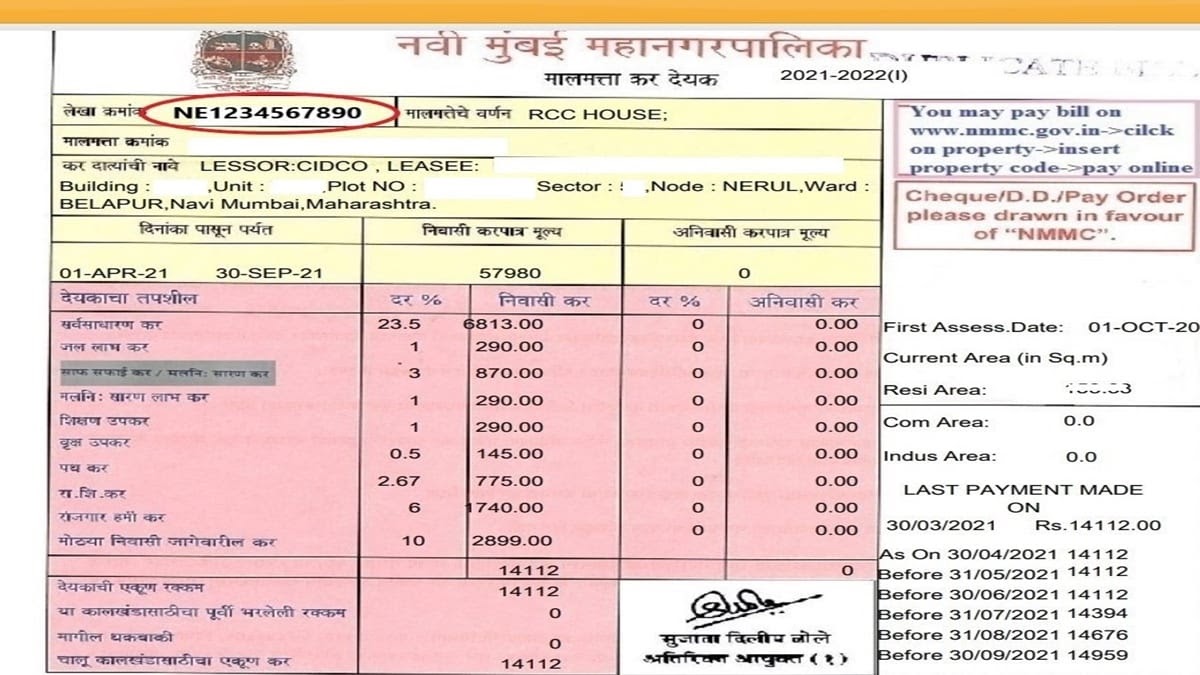

Nmmc Property Tax Calculator Online Payment Bill Details More

Countries With No Property Tax Tax Free Countries

Efficient And Equitable Tax Systems Lincoln Institute Of Land Policy

Deducting Property Taxes H R Block

Dakota County Mn Property Tax Calculator Smartasset

Redi Ceo Says High Property Taxes Likely Deterring Growth In Pocatello Local Idahostatejournal Com Property Tax Pocatello Economic Development

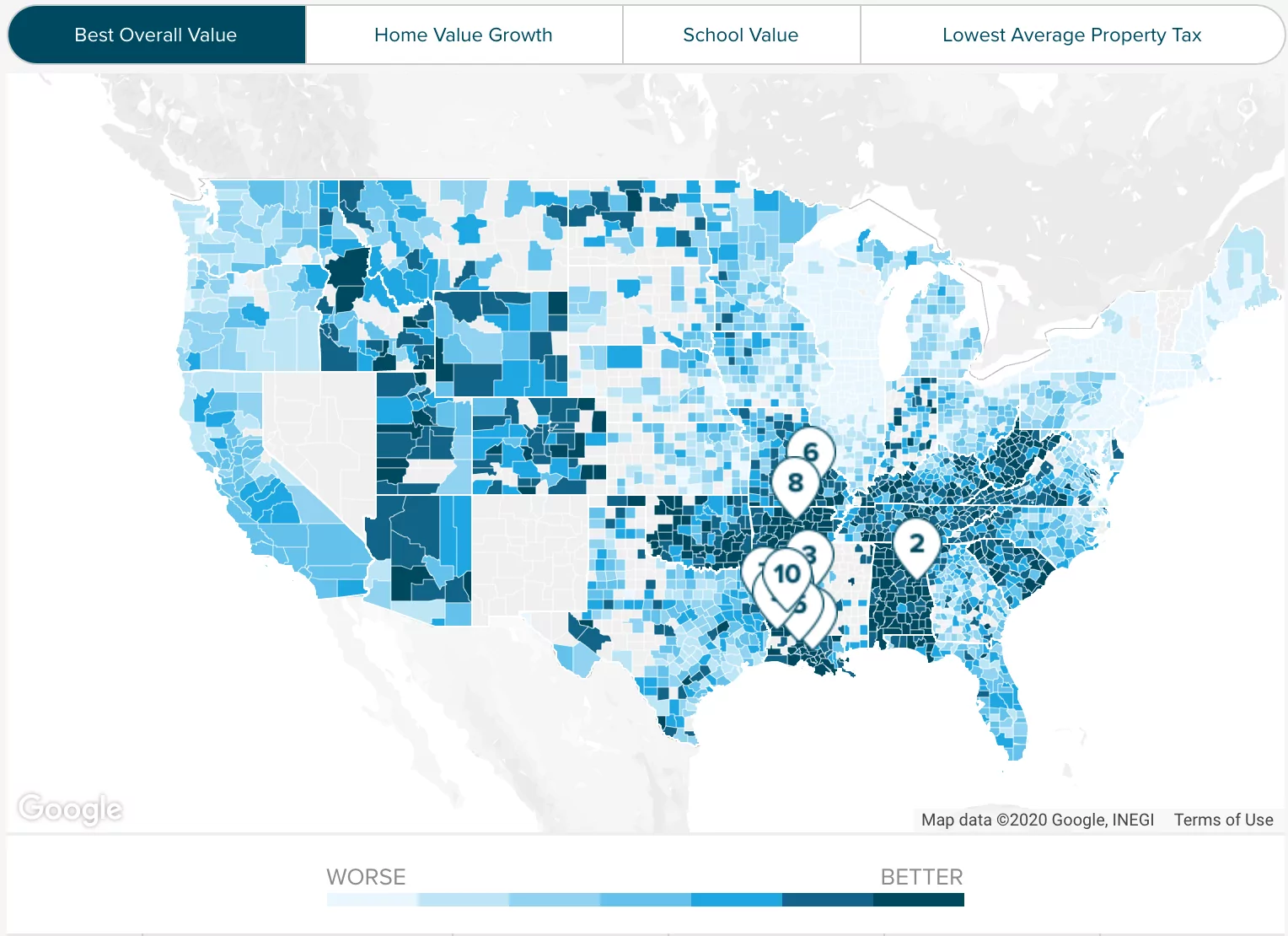

States With The Lowest Property Taxes 2022 Bungalow

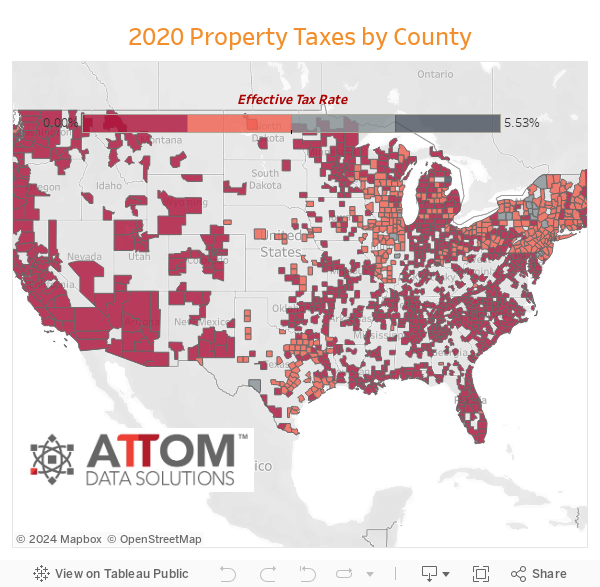

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

What S My Property S Tax Identification Number

Property Taxes How Much Are They In Different States Across The Us

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

All It Takes Is A Big Unexpected Expense Or A Few Months Of Unemployment And You Re Behind On Your Mortgage Or Tax Pa Tax Payment Unexpected Expenses Mortgage

What S My Property S Tax Identification Number

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

States With The Highest And Lowest Property Taxes Property Tax High Low States

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)